I'm a Mathematics Research Fellow at The City University of New York, Brooklyn College.

During my internship in the U.S. House of Representatives for New York's 13 District, part of the Appropriations and Budgeting Committee, I contributed to statistical analysis of $1.2 Trillion+ in federal funds and the allocation of $100 Million+ to NYC infrastructure and community building projects for the year of 2025.

Monte Carlo Simulation for Option Pricing on

Markov-Switching Financial Markets

Built a Monte Carlo simulation framework for stochastic asset pricing across equity indexes, commodities, and individual securities. Implemented derivative pricing models (European, barrier, Asian options) with interactive visualization and

statistical analysis for model validation.

Joint project with D.Pinheiro at

City University of New York,

Brooklyn College.

Slides

Paper (Not Yet Public)

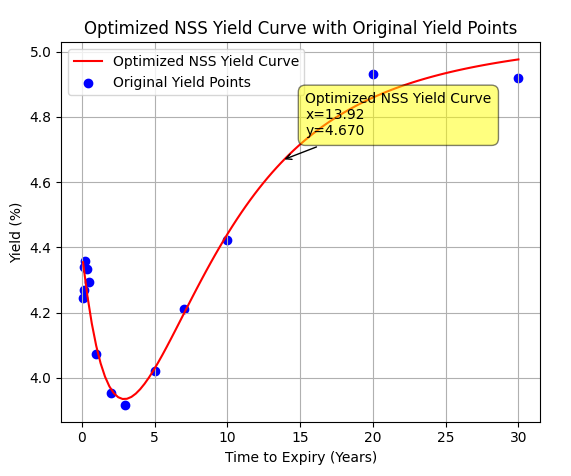

U.S. Treasury Yield Curve Forecasting

Developed a Python implementation of the Nelson-Siegel-Svensson algorithm to interpolate U.S. Treasury yield curves from Bloomberg Terminal data, enabling extraction of risk-free rates at arbitrary maturities.

Notebook

Monte Carlo Simulation for Queueing Model

Simulated queueing systems using Monte Carlo methods to identify operational bottlenecks.

Code